The Accounting Shortage is Shifting

May 14, 2025

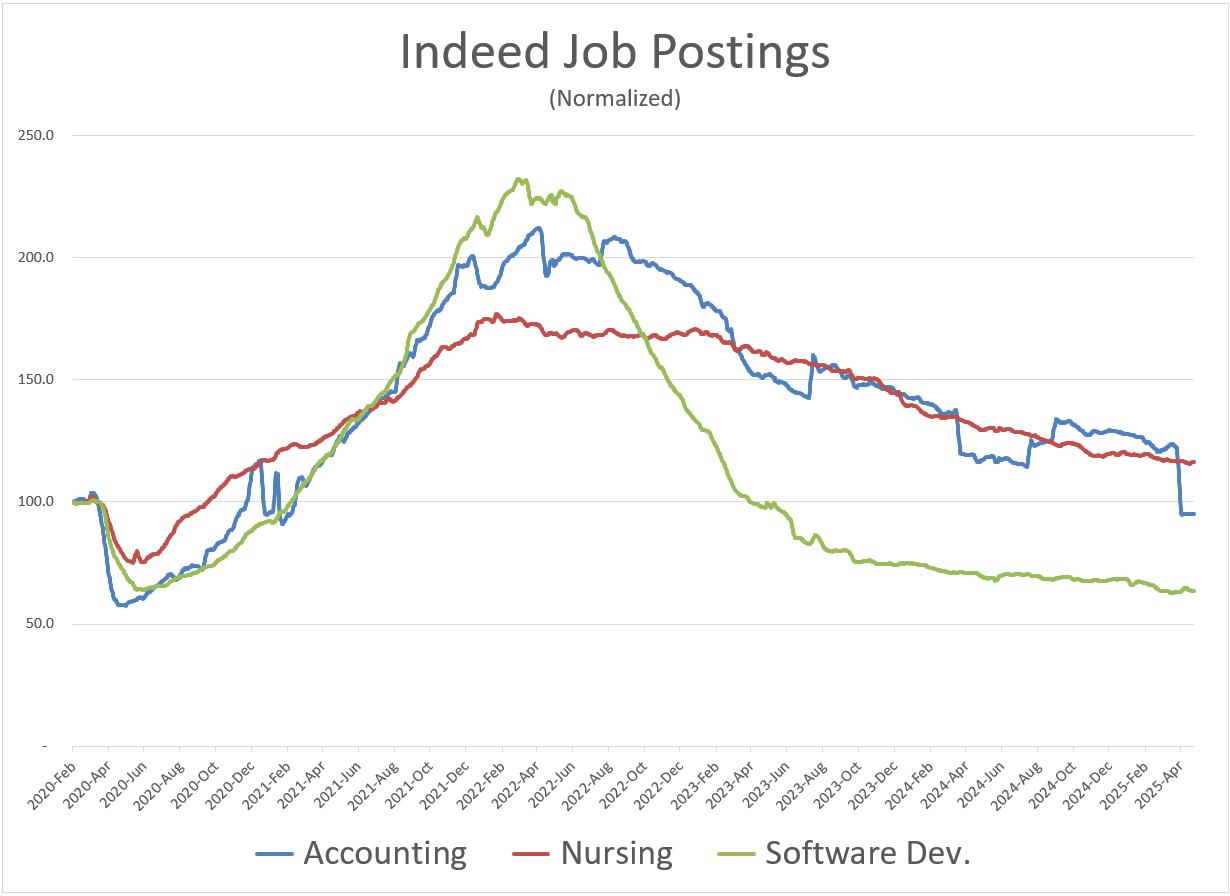

The accounting profession has been grappling with a labor shortage for years. It got worse when COVID-19 lockdowns loosened up and the demand for accountants (open positions) outpaced the supply of qualified candidates.

But the latest job postings data suggests that the demand is shifting for accountants, and other high-demand positions, like software development and nursing.

To understand where it's headed, it helps to understand what caused the shortage in the first place. There were several reasons that this happened, but one factor stands out: Public accounting firms.

Public Accounting Was the Fastest Growing Consumer of Accounting Talent

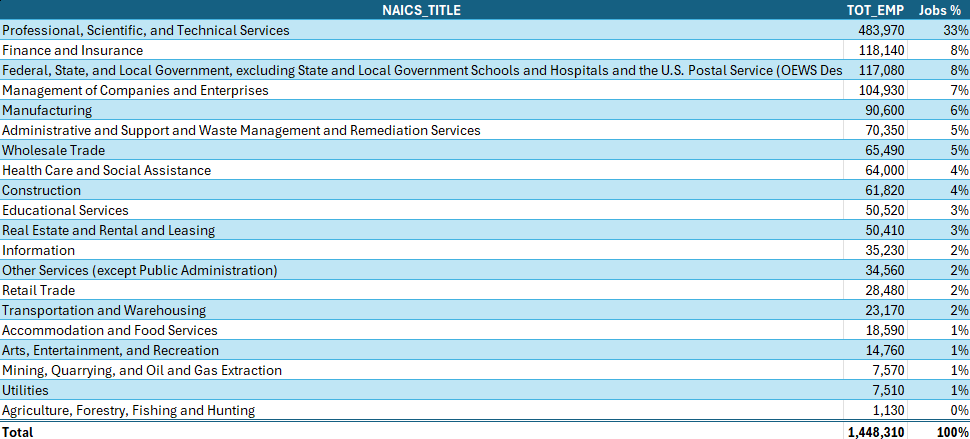

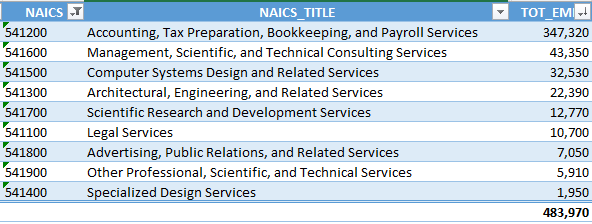

According to the Bureau of Labor Statistics (BLS), 33% of all accountants work in Professional, Scientific, and Technical Services — that's the industry that includes public accounting firms.

Below is the breakdown of where accountants work, and this table is focused mostly on early career accountants because this is a code the BLS uses for positions that may not require experience.

As you can see, one out of every three early career accountants works in the Professional Services Sector.

While “Professional Services” also includes legal, engineering, and consulting fields, public accounting firms — especially the Top 100 — represent a massive share of accounting employment within this sector.

The Post-Pandemic Hiring Surge and Headcount Growth

After lockdowns lifted in 2021, job openings in Professional and Business Services skyrocketed. Factors included:

-

Pent-up demand

-

Federal stimulus

-

Low-interest rates

-

Corporate growth initiatives

This huge growth wasn't present in all sectors. In fact, Professional & Business Services reached the highest growth of any sector during March of 2022, during the country's sharpest spike in job openings in years.

So of all the growing sectors during the great resignation and employee-favored market, accountants found themselves concentrated in the hottest sector.

Within that sector, public accounting firms ramped up hiring during those years to power their expanding businesses. The result?

-

From 2020 to 2024, the Top 100 U.S. accounting firms increased their headcount by over 40%, growing from roughly 370,000 to 520,000 employees.

- The most dramatic increase came between 2021 and 2022, with a nearly 21% headcount jump.

Even as broader job openings in the Professional Services and other sectors began to cool in 2023 and 2024, public accounting maintained high staffing levels. Headcount did not go back down. Accounting firms continued to absorbed a huge share of available talent, especially at the entry level.

Public Accounting’s Unique Hiring Model Amplified the Accountant Shortage

Public accounting operates a little differently than other accounting employers. And those differences deepened the accountant shortage.

-

Volume Hiring: Large firms hire and onboard hundreds or thousands of new people each year.

-

Campus Recruiting Dominance: Firms recruit and contract talent early, often a year in advance, making it harder for other types of employers to compete for talent.

-

High Turnover Cycles: The public accounting business model involves constantly replenishing staff, creating relentless demand for new talent. Turnover rates at many firms approach 20%.

These aspects of their business model meant that public accounting firms were continuously pulling large cohorts of graduates and early-career accountants out of the overall talent pool, and that made the shortage more extreme.

A Primary Driver — But Not the Only One

Of course, public accounting hiring practices didn’t create the shortage alone. Other contributing factors include:

-

Declining CPA exam candidates and accounting graduates (especially from 2019 to 2022)

-

Increased demand for financial reporting, compliance, and advisory roles across industries

-

Competition from tech and consulting firms for accounting skillsets

Nonetheless, when you look at the scale of hiring, the timing of post-pandemic growth, and public accounting’s structural dependence on entry-level hiring, it’s clear they were a primary driver of the accounting labor shortage.

What Happens Next?

As the hiring frenzy cools and attrition rates normalize, public accounting firms may reduce their hiring and seek to trim headcount in areas where employee turnover is low. That means there is risk of layoffs in some firms.

Does that mean the accounting shortage is over? Not quite.

Public accounting firms are adjusting headcounts in certain practices that are overstaffed, but the underlying supply shortage remains. Fewer students, fewer CPAs, and persistent demand mean the shortage is shifting, not solved.

Slower revenue and headcount growth mean firms can be more selective. Grade point averages matter again. Internships are critical. And upticks in recent graduate unemployment suggest that hiring has cooled off—possibly due to global trade uncertainty.

Below is a chart created by the NY Fed, showing recent grad unemployment rising.

For now, the evidence is clear: Public accounting’s outsized demand played a leading role in driving the accounting labor shortage during the pandemic, and today public accounting firm growth has slowed down.

Given public accounting firms' role in creating the shortage, watching what happens next in U.S. public accounting headcounts will be an important signal for what's coming next.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.